When you expand your business internationally, you’ll need to ship your cargo to different countries. To do this safely and in accordance with rules and regulations, you’ll have to pay import duties and taxes on your cargo.

To make this process easier, here is a complete guide to calculating international shipping taxes.

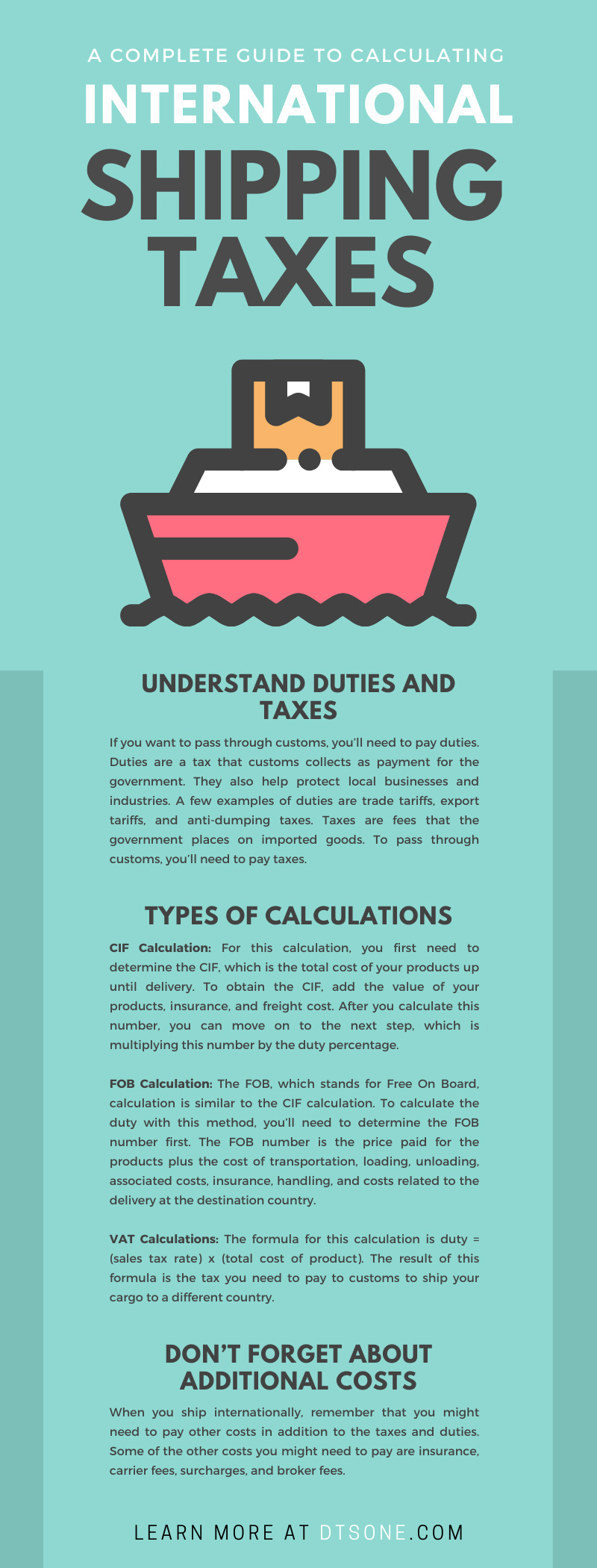

Before you try to calculate shipping duties and taxes, it’s best to learn a bit about these costs. If you want to pass through customs, you’ll need to pay duties. Duties are a tax that customs collect as payment for the government. They also help protect local businesses and industries. A few examples of duties are trade tariffs, export tariffs, and anti-dumping taxes. Since your business will transport goods into a different country, you’ll need to calculate import duties. If your company transports goods out of a country, then you will calculate export duties.

Taxes are fees that the government places on imported goods. To pass through customs, you’ll need to pay taxes. There are a couple of different types of taxes to keep in mind, including sales tax, goods and services tax, import duty tax, and value-added tax. Remember that the tax rates vary depending on the country, so it might be cheaper to ship to some countries than others. These taxes also vary depending on the type of product you transport to the country. The taxes could be as low as 0 percent or 10 percent, or they could be as high as 20 percent or more. It all depends on the specific country and the type of products you ship.

Since taxes vary depending on the type of products and the specific country, knowing a few factors that determine the duties and taxes is helpful.

There are a few different types of calculations you can use to determine the taxes and duties of the products. The first type of calculation you can use to determine the duty is called the CIF, which stands for cost, insurance, and freight. The second type of calculation is the FOB duty calculation, which stands for Free On Board. Finally, the third type of calculation is value-added sales tax, also called the VAT calculation.

Read below to learn how to do these three calculations.

If you want to calculate your duty, you can use the CIF calculation. For this calculation, you first need to determine the CIF, which is the total cost of your products up until delivery. To obtain the CIF, add the value of your products, insurance, and freight costs. After you calculate this number, you can move on to the next step, which is multiplying this number by the duty percentage. Since each country has a different duty percentage for your products, you’ll need to find this number on the government page of your destination country. To summarize, you can multiply the duty percentage by the CIF to calculate your import duty. The formula for this calculation is duty = (product price + cost of shipping + cost of insurance) x (duty percentage).

The FOB, which stands for Free On Board, calculation is similar to the CIF calculation. To calculate the duty with this method, you’ll need to determine the FOB number first. The FOB number is the price paid for the products plus the cost of transportation, loading, unloading, associated costs, insurance, handling, and costs related to the delivery to the destination country. The formula for this calculation is duty = (product price) x (duty percentage).

Before you calculate your taxes, you need to determine the destination country’s sales tax (VAT) rates. You can find the sales tax rates on the government website of the destination country. There are multiple sales tax rates for some countries, but all you need to do is choose the one for your specific products. After you find the correct sales tax rate, you can continue with the calculation. Next, you need to add the value of your products to the insurance, freight costs, import duty, and any additional costs. After you calculate this number, you can now calculate the taxes. To do this, you multiply the sales tax rate by the total cost of the product, which is the calculation you completed above. The formula for this calculation is duty = (sales tax rate) x (total cost of product). The result of this formula is the tax you need to pay to customs to ship your cargo to a different country.

When you ship internationally, remember that you might need to pay other costs in addition to the taxes and duties. Some of the other costs you might need to pay are insurance, carrier fees, surcharges, and broker fees. To transport your cargo safely into different countries, remember to pay your taxes, duties, and these additional costs.

Even with a complete guide to calculating international shipping taxes, it can be challenging for your business to take care of all its shipping needs. To summarize, this guide goes over duties and taxes, additional costs, the factors that create taxes and duties, and different types of duty and tax calculations, including the VAT, FOB, and CIF. If you require international freight services, give us a call at Diversified Transportation Services. We’ll be happy to help you ensure that your cargo reaches its destination efficiently.

Whether you're a company looking to improve one facet of your supply chain, your entire supply chain, or simply looking for a transportation and logistics consultation, we can help.